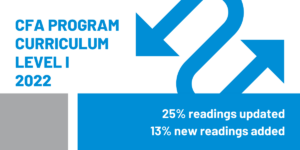

The CFA Institute, renowned globally for its prestigious Chartered Financial Analyst (CFA) program, has played a significant role in shaping the finance industry and elevating…

The Chartered Financial Analyst (CFA) Level 1 exam is a rigorous and globally recognized qualification that opens doors to a rewarding career in the finance…

Introduction: Financial statements are the bedrock of understanding a company’s financial health and performance. They provide a snapshot of a company’s financial position, profitability, and…